Mn Charitable Gambling Rules

- “Minnesota has unusual laws related to charitable gambling,” Knoblach said. “The money that is left over after all expenses and taxes are paid goes 100 percent to charitable activities, yet we tax charitable gambling at a higher rate than any other organization of which I am aware of.”.

- (5) a private social bet not part of or incidental to organized, commercialized, or systematic gambling; (6) the operation of equipment or the conduct of a raffle under sections 349.11 to 349.22, by an organization licensed by the Gambling Control Board or an organization exempt from licensing under section 349.166.

- (5) a private social bet not part of or incidental to organized, commercialized, or systematic gambling; (6) the operation of equipment or the conduct of a raffle under sections 349.11 to 349.22, by an organization licensed by the Gambling Control Board or an organization exempt from licensing under section 349.166.

As part of an effort to pass more money onto worthy causes, organizations could see a sales tax exemption for items related to charitable gambling.

Sponsored by Jim Knoblach (R-St. Cloud), HF3384 would provide a sales tax exemption for equipment used, and items purchased as prizes, for charitable gambling. The bill was held over by the House Taxes Committee Thursday for possible omnibus bill inclusion. Its companion, SF3384, sponsored by Sen. Jerry Newton (DFL-Coon Rapids), awaits action by the Senate Taxes Committee.

Minnesota Gambling Control Board Rules. The rules for lawful gambling electronic games, sports tipboard games, and other lawful gambling provisions are effective on Monday, July 15, 2019. For those of you affected by language requiring compliance within 180 days from the effective date of the rules, that date is January 11, 2020. (1) by an organization in connection with a county fair, the state fair, or a civic celebration and is not conducted for more than 12 consecutive days and is limited to no more than four separate applications for activities applied for and approved in a calendar year;.

The bill would also extend the sales tax exemption for items purchased for prizes at festivals, fairs and carnivals to include those for charitable gambling, with an added provision to exempt the lease or purchase of gambling equipment for an organization licensed to conduct lawful gambling.

WATCH Full video of the House Taxes Committee hearing

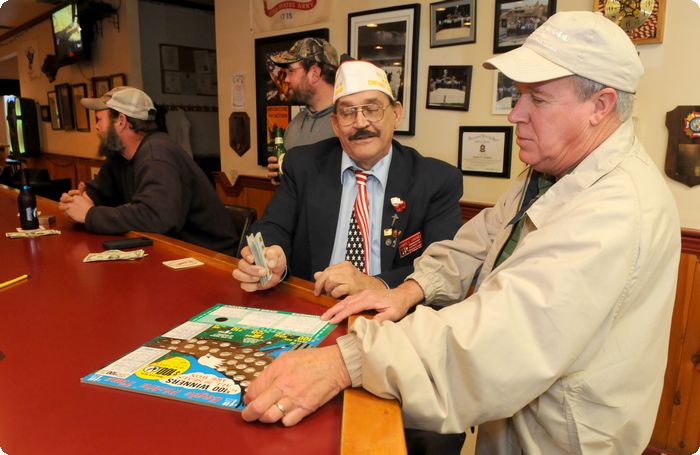

Exempt equipment could include permanent items such as electronic devices and software, as well as disposable goods like pull tabs and bingo cards.

“Minnesota has unusual laws related to charitable gambling,” Knoblach said. “The money that is left over after all expenses and taxes are paid goes 100 percent to charitable activities, yet we tax charitable gambling at a higher rate than any other organization of which I am aware of.”

Knoblach estimates lifting the tax would increase contributions by several million dollars per year.

Many states have enacted laws exempting certain charitable gaming activities from the applicable anti-gambling laws.

Websites containing state statutes are available for all states, although they may be out of date. The excerpts presented here are taken from those websites. It may take a long time before new provisions of a state law are incorporated into the online text the state makes available. Before acting on any information contained in RealGamblingUSA.com you should get up to date and to the point advice from a lawyer.

The most commonly exempted activities are bingo and charitable raffles as well as certain types of casino games. Hawaii and Utah do not have any charitable gaming laws.

Mn Gambling Rules And Regulations

The charitable gaming laws from all states that have them are listed in the table below. To view the applicable state law click on the name of the state.